REALTY BUNDLES: March – May 2025 Updates

We’re excited to share our updates and achievements from March and May 2025. Over the past couple of months, we’ve completed several projects, added a new layer of security to our mobile app, and published additional professional articles.

BUNDLES – WHAT’S NEW?

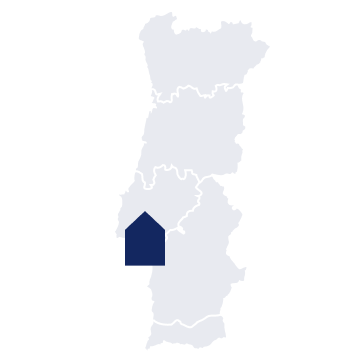

The Bundle completed another exit: the sale of a four-room apartment innear Lisbon. The return combines rental income and property value appreciation per the business plan.

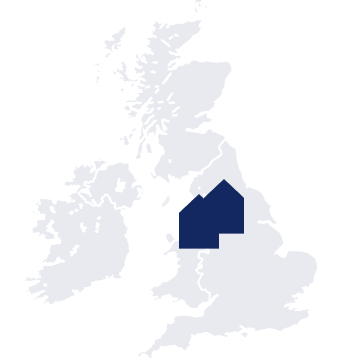

The UK bundle exited two projects: the properties in Wallasey and Gatley, Manchester, were sold at auction after the local developers failed to complete construction.

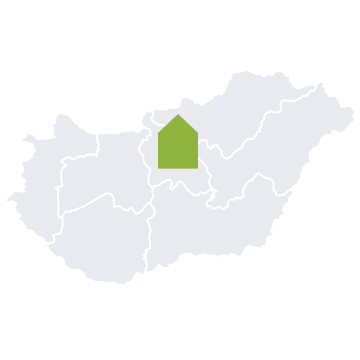

The project converting attic space into luxury apartments in central Budapest is ongoing. Progress has been made on the interior of the apartments, and construction of the new structure has begun.

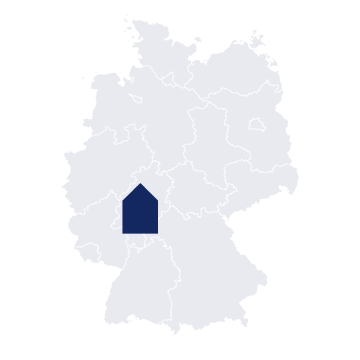

The Europe Bundle exited the project in Langelsheim, Germany, without a profit after the assets were sold at auction by the bank.

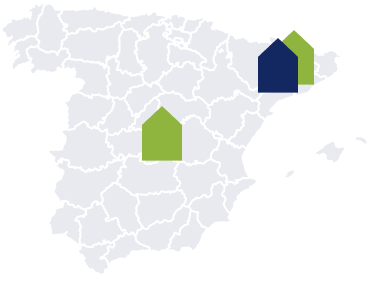

The Passeig de la Pau project obtained its First Occupancy License in March 2025, enabling the registration of the deeds for the sold units. A partial capital repayment is expected once the developer secures the necessary funds. Two residential properties and one commercial premises remain unsold, and the developer plans to retain these units to maximise returns.

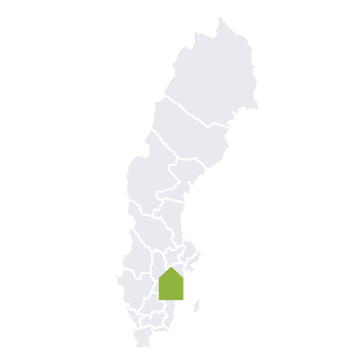

The construction of eight flats near Stockholm is progressing. All six apartments in phase one are sold, with four already occupied and two to be occupied by spring 2025. The sales proceeds will fund the completion of phases two and three rather than the loan repayment.

The Church & Adelaide development in Toronto, Ontario, continues to advance through the planning approval process. Following successful negotiations with neighbours, the eastern setback requirement was removed, allowing for an increased gross floor area. The zoning and site plan applications x have been resubmitted incorporating this increase.

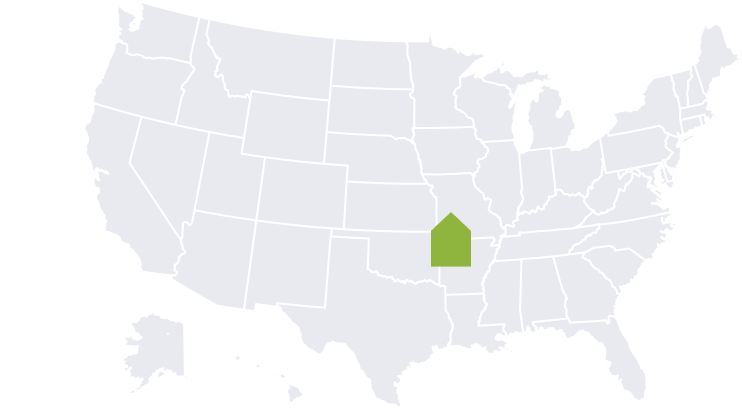

The residential properties in Kansas City are maintaining stable occupancy. Parkville Flats continues to see strong tenant demand with recent lease renewals, while Woodhaven applies a proactive approach to lease renewals and tenant turnover to optimise rental performance.

SMART BUNDLES Launch & Enhanced KYC

We are pleased to announce a new and improved version of the KYC process on our platform. The new update includes a liveness check, which adds an extra layer of security to protect our clients. As before, we continue our collaboration with Ondato to ensure fast and reliable KYC and AML processes.

In parallel, we are officially launching of the SMART BUNDLES platform, a licensed investment platform that makes real estate accessible to everyone.With this launch, we’ve also opened our first fundraising round to give the public a chance to become shareholders and join us in reshaping the future of real estate investing.

Team Updates:

We are pleased to welcome Maayan Meltzer, founder and former CEO of Fundit, who has joined our team part-time. His focus will be connecting us with institutional investors and larger ticket firms in Israel, as well as supporting the development of SMART BUNDLES as a leading platform in the region.

New Articles on the REALTY BUNDLES Blog

- What are the key opportunities and risks for real estate investors? How can investment strategies be adapted to accommodate rising interest rates, and how does this align with REALTY BUNDLES’ strategy? You can find all the answers in our new article >> Read here

- You can also explore a real estate overview of Atlanta, U.S., focusing on key trends, property types and the factors influencing investment opportunities. Also, how is the city’s economic growth impacting the real estate market, and what are the most promising areas for buyers and investors? >> Read here