Annual Update to the REALTY & SMART Community

The year 2025 marked a pivotal milestone in the evolution of the group. It was a year defined by strategic groundwork, execution of complex transactions, and a clear transition from preparation to realization and scalable growth.

Below is a concise overview of the key achievements in 2025, followed by our strategic outlook for 2026.

- 2025 Achievements – From Infrastructure to Execution

- Looking Ahead – Key Objectives for 2026

- In Closing

2025 Achievements – From Infrastructure to Execution

Adapting the SMART Platform to Real Estate Investments

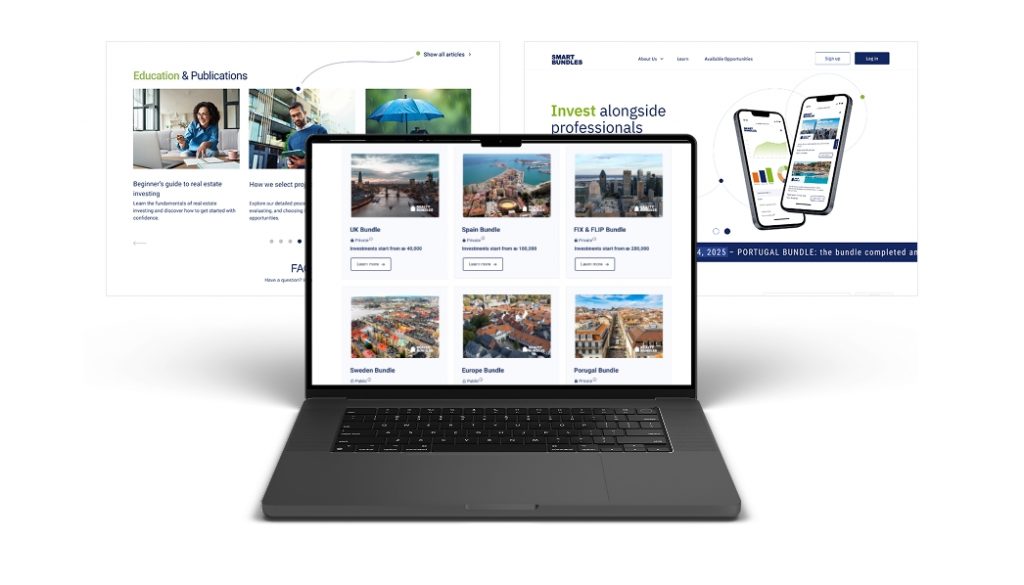

Throughout 2025, the SMART platform underwent a comprehensive transformation to fully support managed real estate investments. This included technological, operational, and regulatory adaptations, positioning SMART as a dedicated infrastructure for complex real estate investment structures.

Private Fundraising – Fully Executed via the SMART Platform

One of the most significant achievements of the year was the execution of private fundraising rounds for more than six different Bundles – all conducted entirely through the SMART platform.

This validated SMART’s ability to serve as a central hub for investor onboarding, documentation, compliance, reporting, and end-to-end investment management.

Completion of the SMART Platform Acquisition

During 2025, REALTY completed the acquisition of the SMART platform.

This strategic transaction created full synergy between REALTY’s real estate expertise and SMART’s technological and regulatory infrastructure, forming a unified and scalable investment group.

Substantial Progress in the Prospectus Process

The first stage of the prospectus preparation was successfully completed in 2025.

The group is currently advancing through the refinement stages, with submission of a draft prospectus expected in February, a critical step toward regulated and transparent expansion.

Preparations for a Distributed Bond Fund

Significant groundwork was laid toward the establishment of a distributed bond fund, based on an Offering Coordinator license.

This strategic initiative is designed to broaden the product offering and provide investors with additional, professionally managed investment channels.

Regulatory Approvals for the Cyprus Fund

Regulatory approvals were obtained to operate the Cyprus-based fund under a prospectus framework, enabling structured European activity and cross-border investment opportunities.

International Expansion – UGINING Fund

In 2025, the group advanced its European international activity through the UGINING fund, focusing on stable markets with clear regulation and long-term growth potential.

Strategic Partnership – KOSHER BUNDLES

A strategic collaboration with Hadran was promoted to facilitate real estate investments for the ultra-Orthodox community under the KOSHER BUNDLES brand, ensuring full cultural, operational, and regulatory alignment.

Expansion of Developer Partnerships

The group significantly expanded its partnerships with developers and entrepreneurial companies in Israel and abroad, enhancing deal flow, diversification, and professional oversight.

Infrastructure Expansion for Scalability

Throughout the year, substantial investments were made in technological, operational, and compliance infrastructure, laying the foundation for accelerated growth in the coming years.

Launch of New Investment Bundles

Two new Bundles were launched for investors seeking high potential and innovative investment opportunities:

USA Fix & Flip Bundle: Focused on rapidly improving residential properties in the U.S. market.

Urban Renewal Bundle in Israel: Designed to engage investors in local projects aimed at shaping the future of the real estate market.

Looking Ahead – Key Objectives for 2026

2026 is expected to be a year of acceleration and growth, focusing on:

- Submission and advancement of the prospectus

- Launch of the distributed bond fund

- Expansion of European and international activity

- Increased fundraising volumes and bundle offerings via the SMART platform

- Strengthening investor relations and transparency

- Continued infrastructure development to support long-term scalability

In Closing

The year 2025 was defined by disciplined execution and strategic positioning.

The year 2026 represents the next phase – growth, expansion, and realization of the long-term vision.

We thank you for your trust and partnership and look forward to continued progress together.