By Yehonatan Gourvitch

Table of content

- Who is Yehonatan Gourvitch

- A Short History of Portugal Real Estate Market

- Trends in Portugal

- YGI Investment Strategies Our Approach

Who is Yehonatan Gourvitch?

My name is Yehonatan Gourvitch, I am the CEO of YGI investments. We are a full service investment company based in Lisbon, and the Lisbon metropolitan area is our main field, although we operate all over the country as well. We have two arms of operation:

- one deals with bigger and more professional investments, such as building developers - for both residential and office buildings in the city center and outside in the outskirts

- and the other, called Casa Portugal, is aimed at smaller investors who are looking for apartments or restaurants with yields. These investors are usually not professional so we facilitate their investments for them.

A Short History of Portugal

One could say that Portugal was frozen for many years and there was not so much going on here. But something happened about 7 years ago and Portugal was suddenly on the right track and the economy started to boom. Portugal was the first to climb out of the last crisis.

The economic boom happened in every field of the economy, not just in the real estate market. The economy started to move forward. Most Portuguese people’s pessimism has been replaced with optimism in the last few years, and for good reason too.

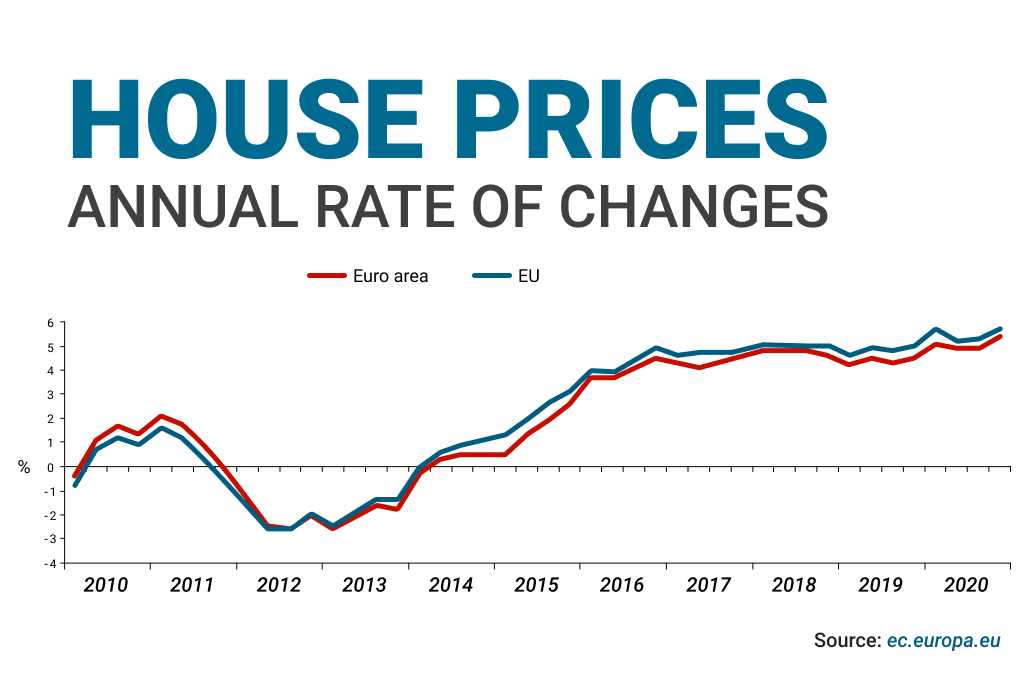

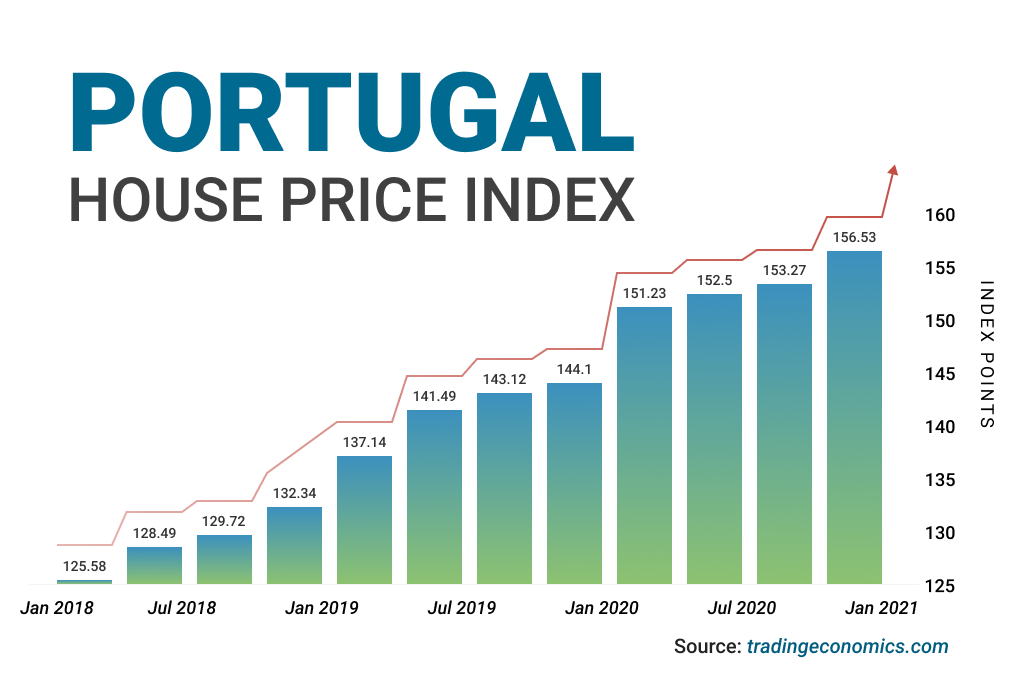

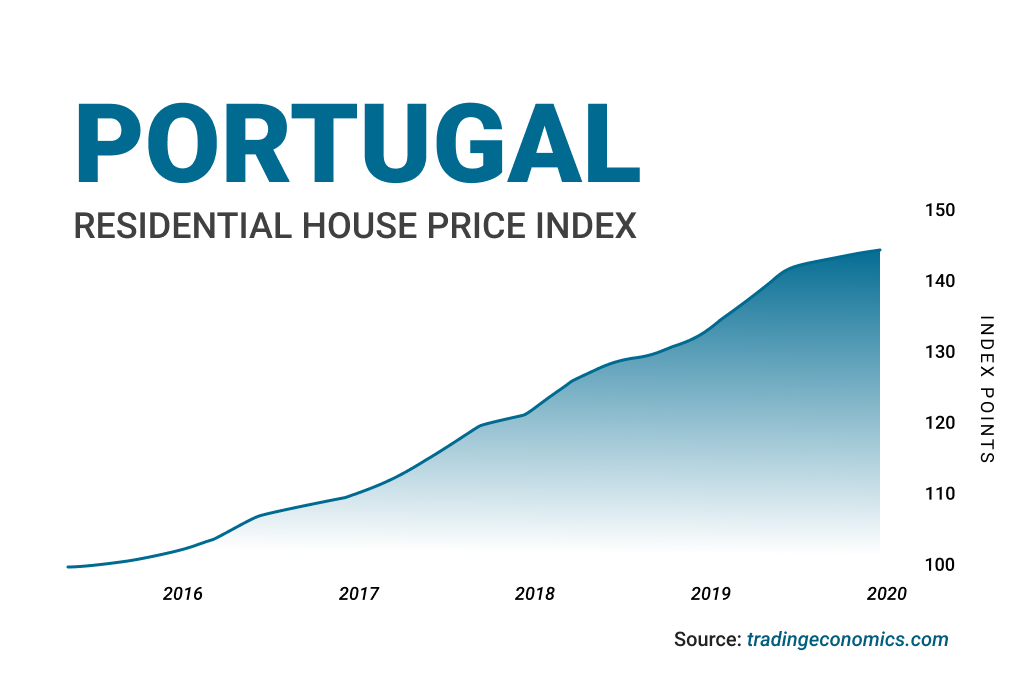

As Eurostar reports, house prices rose in the euro area for the fourth quarter of 2020 compared to the same period in 2019. At the same time, house prices in Portugal rose almost double that of the rest of Europe and most reports and analysis suggest that Portugal is still going to be a center for foreign investors.

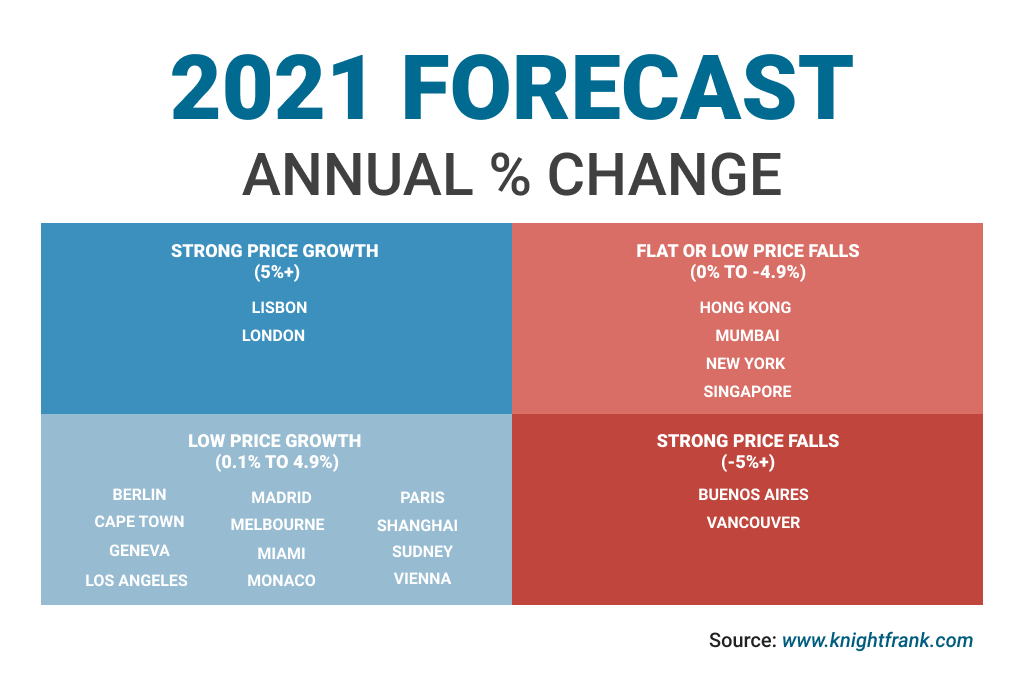

The Knight Frank Intelligence Lab reports that as markets look to rebound post-Covid, Lisbon sits in front of the queue projected to be one of the four major prime residential markets. “In Lisbon, Portugal’s handling of the crisis combined with strengthening demand and limited prime supply, will underpin price growth. A number of other European markets such as Berlin and Madrid are also expected to rebound well.”1

Real Estate Market Trends in Portugal

What happens in the graph above is that a lot of money came in and was invested in the city center, in luxury housing, hotels, restaurants, and clubs that were not there before. Then the prices in the city center grew and local people headed out to the outskirts and discovered that life outside the city was more quiet and had less pollution, better parking, and new parks, signalling even more development outside the city center. So there is a vibrant and active market in Portugal where there are all kinds of small luxury and hospitality operations inside the city and developments tailored to the middle class in the outskirts and suburbs. That, basically, is the fuel driving the market.

YGI Investment Strategies

Above are some of our recent projects. The two on the left are old buildings in the city center bought for investors, refurbished, and the apartments sold or rented with AirBnB. The middle building also has a large commercial center. The one on the right is a project outside of the city. More market share is being targeted towards similar properties that are new and built from scratch. There’s an increasing demand for such properties.

As we handle property and project management for foreign investors, we have a team that looks at the market a little bit differently. These apartments, for example, were on the market and were offered at a market price. The owner published the apartment by 50 sq meters but the apartment’s papers showed 30 sq meters. Of course, the owner had a problem convincing anyone that it was 50 sq meters, but we knew for sure that it was bigger, and anyone can go to the apartment and see the actual size.

The only thing we could do was call for an engineer who went to the apartment and clearly found that the apartment was much bigger. We reserved the apartment, spoke to the owner, and asked to help measure and update the apartment’s documents with the municipality. That was what we did, and the apartment that was registered as 30 sq meters became 98.5 sq meters, almost double the apartment’s value. We could do this, and quickly, because we had the team and the expertise. This is one way of adding value to an asset.

Here is another apartment that was bought just a little lower than market price. However, the investor wanted to rent it and get good yields. What we saw was that it was very easy to make 2 units out of the property at almost zero cost because of how the building was constructed. Once split, both units were rented out individually thus doubling the rental income compared to if it was rented as a single unit.

This is our approach to the market. We have the time, and we look very carefully for easy solutions, how to either add value to the property or get better yield than the market suggested, or both.

You can learn more about Portugal Property Bundle on the website.

Sources